Good Morning and thanks for hanging out with us on international student loan.

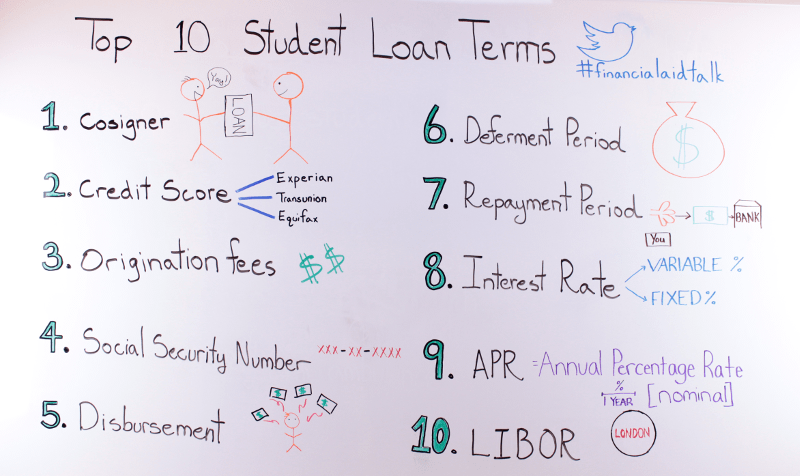

Today we are going to talk about a popular subject and that is the Top 10 key terms that you need to know in order

to apply for your student loan. Before we get started, I just wanted to let you know that I will be answering all of

your questions live online, so make sure you send in all of your questions. You can do that in the google screen

that you are looking at, or through Facebook or Twitter. We will also be having a conversation at #FinancialAidTalk

so please join the conversation after our presentation where we can engage on the subject and make sure we get all

of your questions answered.

So with that being said, let’s get started. So when it comes to International Student Loans or even study abroad

loans, now is the time to be thinking about it. And it is a time where you’re thinking about the cost of tuition,

books, health insurance, and all of the other things that add up. Do you need help covering those costs? Student

Loans are a great way to do that. What we are going to do is talk about the key terms that when you are comparing

these loans side by side you know which ones to look at, you know which would work better for you, and you can apply

for those right online.

With that being said let’s get started right away. The first student loan term which is the most important one is

the Cosigner. Your cosigner is the person who is basically guaranteeing your student loan. So they are the ones who,

if you can’t pay back your student loan, will pay instead. Now, when it comes to your cosigner, it’s very important

that you make sure that they’re U.S. citizens or permanent residents, that they have lived in the U.S. for the last

two years, and that they have good credit.

That brings me to term number 2, and that is your Credit Score. Now you may have heard this term before, but

basically, what a Credit Score is the credit “worthiness” of either you or your cosigner. Now, keep in mind, if

you’re an international student, you will need a cosigner. If you are a U.S. student, it will help the likelihood of

getting accepted and under better, more favorable terms. So make sure that you know what your cosigner’s credit

score is. Your credit score is essentially a number, a numerical value that identifies the financial responsibility

of that person. So, it takes into consideration all of the financial history and gives them a number. And then, the

Student Loaners will basically evaluate that number and then give you a price, or a cost of borrowing that loan, and

it is very important. Now if you want to know what your credit score is, or your cosigner wants to know that their

credit history is, you can get access to that. There are three major companies to do that: Experian, Transunion, and

Equifax. These three companies will allow you to get a free report every year so you, or your cosigner, can go in

and see what that is. Once you have found your cosigner and made sure they have good credit, you are ready to start

the application process.

That brings me to our next key term – Origination Fees. Origination fees are basically a cost to have the

application. So when you apply for your student loan, you may or your may not have a fee associated with it. The

good news is, that will all of our student loans on our InternationalStudentLoan.com site, you can see all of the

loans and apply for them as well, and there is no origination fee. So you can apply free of charge. Now if you’re

going to be looking at other student loan options, make sure to review the terms and conditions, and contact your

lender to make sure that there are not any surprises along the way.

Once you are ready to start the application, you may see this term which is Social Security Number. If you are a

U.S. citizen you are probably very familiar with this term. If you are an international student you may have seen

this, or you may have one of your own. Basically, the Social Security Number is the number that identifies you. You

use this number when you apply for credit cards, you use it for student loans, and you even use it when you are

applying for your taxes. So it is a very important number. If you are an international student, you may or may not

have one. If you are working in the U.S. you will have one. If you’re not, that’s ok. When you apply for your

student loan, there will be a field that asks you for your Social Security Number. If you don’t have one, that’s

fine. It is not necessary for a majority of the lenders. If you have any problems with the application, you can

always call the lender directly and let them know, and then they can sometimes send you the paper application. But

for a majority of the applications, you actually don’t need that. When you get to that, you might be able to skip

it. There may be different applications depending on where you are from, so you would just have to indicate that on

the application.

The next important key term is disbursement. The key word here is disburse. Disbursement is basically when you’re

going to get the money. The most important point, right! When it comes to student loans, you want the money for

that! What disbursement does is basically when the lender gives the money to your school who gives you, or

disperses, the money. Now that is going to be very important, especially when you are studying abroad. You don’t

want to be in Spain or Italy and find out that your money is back home. Make sure you contact your school, usually

through your financial aid office, to make sure you know when you are going to receive that money. It is very

important to know when that date is because it allows you to start budgeting and paying off those costs.

Once you start taking back the loans and you have the money, the next step that you will want to know is what your

Deferment Period is. The deferment period is basically how long you have before you start making payments back to

your student loans. It depends on the loan, it depends on the terms and conditions as to when that time will be. You

will have to weigh the pros and cons to those options. Sometimes with certain student loans, you start paying back

those loans right away. There are others that you can defer until up to 6 months after you graduate, so it is really

going to depend on what you prefer. Now obviously we want to wait as long as we can before we start paying back the

loan, but there is a cost and a benefit to that as well. When it comes to your student loan, if you start paying

back right away, then your fee is going to be lower. The cost of borrowing is going to be lower. Now if you wait 4

years, or even longer – 6 months after your graduation to start paying back that student loan, keep in mind that

even though you have that grace period when you haven’t had to make those student loan payments, you are going to

have to pay more. So make sure you know how long that period is going to be. Look at your wallet, look at how much

money you have on hand, look at taking a job right now while you’re in school – all of these are good, important

factors to consider to see when you are going to start paying back the loans.

The next key term, number 7, is our Repayment Period. Number 6 and Number 7 really work together. When it comes to

the repayment period, the key word is repay. So, when you are going to start paying back your student loan. When it

comes to your repayment period, it depends on how long those payments are going to continue until. It could be 15

years, it could be longer. So, basically, it is making those monthly payments for “how long?” Now, the same thing

with the deferment period, when it comes to repayment period, the longer you’re making those payments, while the

cost per month will be lower, the amount you pay on top of the actual student loan amount will be higher. Now if you

have a shorter repayment period, you’re going to have larger repayments per month, but you will be paying less

overall after the full loan is completed. So, again, you’re going to have to weigh your pros and your cons. What I

also suggest is looking to see what your job opportunities are, and how much you are going to be making, that way

you make the smart decisions as you evaluate these issues and different student loan options.

Now this term, Interest Rate is extremely important. That is your cost of borrowing. Your cost of borrowing is

expressed in an interest rate; expressed in a percentage. What it is saying is that on top of the cost of what you

borrowed, how much you are going to pay in addition. Now there are two kinds of interest rates. There are the

variable interest rates and there are the fixed interest rates. Variable interest rates fluctuate, and so that means

it is going to be tied to some sort of index. Basically, that is a percentage that will vary, it could be by day,

and it could be longer than that. It just depends on those terms. A fixed interest rate is basically a flat interest

rate. So the good news with a fixed interest rate is that you know how much you are going to pay every month. With a

variable interest rate, that can fluctuate. That can be good, or it could be bad. In some cases, if you have a fixed

interest rate, you may be paying more or less than a variable interest rate. So make sure that you consider that.

Would you rather know what you’re going to be paying, or would you rather get a more favorable rate and take the

risk if it is no longer as favorable as the fixed rate. Again, these are all important decisions, and when you are

comparing your different student loan options you will want to evaluate this.

Staying on the same terms as interest rate, there are a couple of terms within interest rate that you are going to

want to know because you are going to see it on your student loan application. The first is APR, and you will see

this a lot. In fact, if you go to our site on INternationalStudentLoan.com and you click APPLY ONLINE and you see

the list of lenders that will work for you and your school, notice that it says APR. What APR is is the annual

percentage rate. It is basically a nominal interest rate. It is not the total cost of what you will pay, but it is a

good indicator of what you can expect to pay, and what it allows you to do is to compare different student loan

options. That number is a requirement for all private student loans in the U.S. You’ll be able to see what that

number is and evaluate what those costs are. It is over a 1 year period – that is how they calculate it, but don’t

think that the only amount you are going to pay, because, again, it is nominal, so it is not adjusted for other

factors such as inflation. It does give you some insight in to what you should expect to pay and compare the

different loans on nominal, straight terms.

Now we talked a lot about the variable interest rate, and that is where the LIBOR is going to come in. LIBOR is an

interest rate that is published every single day by London Baines and it is basically the percentage that bank

borrow from each other. So, while the rate itself doesn’t actually matter, your variable interest rate will be

somewhat set to that rate which can have an effect on the student loan that you go with. So every day, at 11AM on a

business day, they publish those rates, and again, that’s just another term for an interest rate that is basically

with the market. So that is an overview on key interest rates and key student loan terms that you are going to see

when you do the application. Now is the time to start thinking about it. Student Loans, if you apply now or in the

next couple of months, you’ll be able to get your student loan by the beginning of the semester in August or

September depending on when your school starts. So start thinking about these terms. It is very important that you

understand them so that you can have a successful education and you are financial aid smart as well.

Question & Answer

Answer: There are a lot of student loans out there, whether you are a U.S. student or an

international student, you are going to have to evaluate your student loan options. It might not be so

crystal clear. What happens is that your school certifies the loan. So the lender has to work with your

school for you to even be eligible for the student loans. So when you go on to our site

InternationalStudentLoan.com and click APPLY ONLINE you will be able to compare your different student loan

options right there. You will see a lot of these terms and now that you know them, you will be able to

evaluate the option that is right for you. Then, you can actually apply right from there. So, that’s a great

place to start- to look and evaluate your terms and conditions to see what is right for you.

Answer: Great Question. Important Question. There is a huge difference between scholarships

and loans. Scholarships are basically aid that is given to students that you don’t have to pay back. It is

always great to maximize your scholarships because, again, it is basically free money. You don’t have to

worry about, at the end, paying back plus the cost of giving it to you. Keep in mind though, those

scholarships can be competitive. There are a number of places that you can look. You can ask your school.

There are a lot of private scholarships out there as well. If you go to IEFA.org you can search scholarships

that are right for you, it is a great place to do that. Keep in mind though, even if you maximize your

scholarships you might have a gap where you can’t afford the costs. If that’s the case, that’s really when

student loans should come into play. That is because student loans require that you pay back the money that

you have borrowed plus the cost to borrow that money. So you always want to look to maximize your

scholarship grants, and then if you still have money needs left over, you can look to student loans to cover

those fees.

Answer: Great Question. We get a lot of questions about cosigners from international

students especially because it is hard to find a U.S. cosigner. All of the U.S. Student Loans, all of the

U.S. private loans do require that you have a U.S. cosigner. So even if she is in Montreal and she is

Canadian, it will not work. It has to be a U.S. citizen or permanent resident. Keep in mind also, they have

to have lived in the U.S. for the last 2 years. So even if you have a cosigner who is a U.S. citizen living

in Montreal – let’s say if your wife is a U.S. citizen living in Canada, she will have had to have lived in

the U.S. for two years to be able to cosign your loan. We get a lot of questions on it. You can find more

information on how to find a cosigner on our Resources page of International Student Loan. We have some

videos and some different ways to approach people to cosign a loan. Keep in mind that it is a huge

undertaking for someone to basically say that they are going to pay back thousands of dollars for you. So,

be prepare when you ask. Ask your friends, ask your family members. You really want to engage with them to

see what options exist for you. If you do not have a U.S. cosigner, unfortunately the student loans will not

work for you. It is very important that you look and evaluate your options.

Answer: Unfortunately, distance learning does not qualify for student loans. You have to

physically be located overseas. So, if you are going to be doing an online distance program I would

recommend calling them and asking them if they know of any options for you. They may have ideas because they

work with other international students. For online distance learning, usually you are back home and because

of that, financial aid is very restricted.

Answer: Yes! You can be an undergraduate student, you can be an associate degree student,

or you can be going for your master’s degree. It doesn’t make a difference. As long as you are a part time

or a full time student, you are eligible for the student loans. You do need to be attending an accredited

university or a college and if you wanted to see the student loans that are available to you, you can go on

to InternationalStudentLoan.com, click on APPLY ONLINE, choose your school, and see the list of options

available to you right there.

Answer: Great Question. Scholarships – there are a lot of scholarships out there – you just

have to look. Like I mentioned before, go to IEFA.org and you will be able to see a list of scholarships

there. You can actually search where you are going to be studying. You can put “Canada” there and see the

list of scholarships available. As for student loans, it is going to depend on your citizenship. U.S.

student loans are only available to international students coming to the U.S. or U.S. citizens going abroad.

So if you are going to be a U.S. citizen going to Canada, that’s fine. If you are going to be studying

abroad and getting credit in your home university in the U.S. or in Canada, you are eligible for our student

loans. Again, go to our site, InternationalStudentLoans.com and you will see the list of lenders there. If

you are from a different country, a non-U.S. citizen or permanent resident, then the U.S. loans will not

work. They will not work for non-U.S. students going to non-U.S. locations. You may want to ask your school

and find out of any other options.

Answer: For these U.S. private student loans, they do require a U.S. cosigner. Like I said

before, it can be tough to find someone who meets the requirements of being a U.S. citizen or permanent

resident, having good credit, and having lived in the U.S. for the past 2 years. It is critical in order to

apply. So if you do not have someone to cosigner your loan, unfortunately these private U.S. student loans

will not work for you. But, you just need one (cosigner). So if you talk to your friends, family members,

and ask them if they know of anybody who would be willing to do that for you then you’re set to go.

Answer: Yes! If you are a U.S. citizen or permanent resident going to China, then you are

eligible for our student loans. That is no problem. You just have to be either getting credit at your home

university, and that university in the U.S. has to be accredited and approved, or you have to be earning

credit at your university in China and they have to be accredited and affiliated. If you are not quite sure

if they are, you can go onto our site InternationalStudentLoan.com and under eligible countries you can look

for China. Otherwise, you can use the APPLY ONLINE function and you will be able to see what lenders are

available to you.

Answer: Applying for a student loan is pretty easy if you have your U.S. cosigner.

Basically what you’’ do is go onto the APPLY ONLINE page on InternationalStudentLoan.com, you’ll put in your

details, you’ll see the list of lenders that will work for you, choose the one that is right for you, and

the whole process can be done right online. You will need to get the information from your cosigner. Make

sure to have that dialogue. Get their personal information such as their phone number, email address, and

address because they will need to fill out some information.

Answer: You may get a notification that you are pre-qualified in just a few days. The way

the student loan process would work on the back end is once you submit your application you’ll get

pre-qualified. They’re going to review the information. The whole process before you receive the funds will

take about 15 to 90 days depending on the process. What happens is, on your student loan, the lender will

verify the amount of money you are taking out with your college or university so it also depends on them as

to when they have made that approval. So, make sure you are in contact with them. Do it now, do it in July

and August – that is the best time to apply so that you can get the money before school starts.

Answer: Again if you are not from the U.S., and not going to a U.S. university then our

student loans will not work for you. You can look at scholarships, grants and go into IEFA.org and find

that. Otherwise, I recommend contacting your school and seeing if they know of any financial aid that can

help you.

Answer: That goes back to our student loan term that we talked about – your deferment

period. When is your deferment period? That is going to vary by your lender. So, you may start paying back

your student loan after the funds are given to you or you may be able to delay it as long as 6 months after

your graduation. So, that’s just going to depend, so make sure that you review the terms and conditions. If

you have more questions, contact your lender, and ask them because they will be able to assist you. Then,

you will be able to figure out when you have the ability to start paying back those student loans.

Answer: So, when it comes to student loans, there is no U.S. citizen restriction, which is

great news for all of you international students. You can really just apply as long as you have a U.S.

cosigner. So, all you would need to do is go online and apply for it. You are going to be eligible for it if

you are enrolled in a U.S. institution or a U.S. citizen going abroad. There is no program requirement on

that, which is great news. You can be doing your Masters, you can be doing your undergrad, or your

associates, and you will be eligible for the loans. Now, keep in mind that your school does need to be

accredited and has to have a relationship with a lender. So, if you’re not quite sure which lenders to look

at, you can go on to InternationalStudentLoan.com, APPLY ONLINE, and you will be able to see that list of

lenders. We have already done the hard work for you so we have taken that into consideration so that you can

see the list of lenders there. Once you submit the application you will get paid the amount of money that

you are looking for from your university in between 15 to 90 days. You will want to contact your financial

aid office because they are the ones who determine when the actual money is paid out. The good news is that

you can apply year-round, so while now is a huge time for international students because the new semester is

going to start soon, you can actually apply for each term or throughout the year. So there are no

restrictions on that. Then, you will get the money back from the lender through your university and then it

is just a matter of your Deferment Period. So how long are you deferring? When are you going to start making

those payments? So payments can start right away, it can wait until 6 months after graduation or somewhere

in between. Again, if you want the lower, more affordable student loan, you want to start paying back sooner

rather than later. Again, that will just depend on your budget, that’s going to depend on how much money you

have on hand to start making those payments back.

Answer: Unfortunately, if you are not a U.S. citizen and you do not have a U.S. cosigner,

these private student loans through these U.S. lenders, will not work for you. And the reason for that, just

so I can give you more information as to why, because I know a lot of you – it is hard to find that U.S.

cosigner. Basically because they are non-collateralized loans. So there is no house, no assets that you are

putting up in case you can’t repay. Because of that, the lender is saying – we will still give you the

student loan, but you need someone with ties to the U.S. that will be willing to guarantee it for you. So

that is the logic behind why you need to have a U.S. cosigner. It is very important. But again, you’ll need

to have that U.S. cosigner in order to start the application process, so before you even start comparing,

you will want to start asking that question. As I mentioned before, family members are a great place to

start as relatives. You may also have friends that know somebody or maybe just friends who are willing to

cosign your loan. Keep in mind that it is a huge undertaking for these people. You need to be prepared, you

need to have the numbers already calculated, and a plan on how you are going to pay it back. That way,

someone is going to be more likely to cosign your student loan.

Answer: Again, you have to have a cosigner in order to apply. The good news is that you can

apply once you are admitted to a school. So you are ready to start the application process, but you will

need a cosigner to actually apply, because the U.S. lenders will need someone in the U.S. who will vouch for

you saying that they will pay it back if you can’t.

Answer: Great question. I think you are really getting to the importance of the cosigner in

this question. This is a huge undertaking because they are putting their credit score on the line. So they

are saying that if you cannot pay, that person will pay instead. So if they have other obligations, or other

debt, that really can affect their credit score. When they run the numbers when you have applied, the lender

is going to look to see what kind of debt that person has, and what their ability is to pay. So all of that

is really going to impact your application. At the end of the day, these lenders are going to look at your

cosigner and the credit score of your cosigner and evaluate your ability to pay; the likelihood or the risk

that you can’t pay back your student loan. That will essentially come down to your interest rate and what

that interest rate is going to be. You won’t get a final confirmation until after you have applied for the

student loan, because that is going to be impacted by it. Let’s say, for example, that you can’t pay back

your student loan. This person is saying that they can pay it back, and if they can’t pay it back, they are

not only on the line for all of those thousands of dollars that they may be cosigning but it will also

affect their credit score. It will affect their ability to get other loans and to take on other debt and it

may impact the interest rate that they get. They may become more risky in that case if they can’t get more

favorable rates. That is why it is so important that you come prepared. Someone who is cosigning your loan

is a huge responsibility and, at the end of the day, it will not only affect you, but could affect their

financial future as well.

Answer: No, even if you have applied for a student loan before, you are still eligible. You

can actually apply for student loans anytime you want, which is really important especially when you think

about this. You only want to borrow the cost you need to in order to apply because, remember, you’re not

only going to have to pay back the amount you borrow, but you have to pay back an extra interest rate on top

of that – so an extra cost to borrow that money. So the smaller the loan you take, the less you will have to

pay out as a cost to borrow that money. You’ll want to be smart about that, you’ll want to think that

through. That way you can take out as much as you need, and then later on if you need more money, you can

always take out another student loan. Whether you have had a student loan in the past, whether you have a

new one, it doesn’t affect your likelihood of getting approved.

Answer: You have already dealt with the most important part, which is finding a cosigner.

Good job, you are ready to start! In fact, the good news is that you are not too late, you are actually

asking at the perfect time. You can start applying now in June, the best time to start applying is July and

August. You can start applying now, and you will get the funds before the start of the new semester. Just

make sure that you get that information in now and apply for it now so that you are ready when that time

comes so there are no delays. But again, you can apply year-round so there is not a deadline for you. So

make sure you have got all of that information from your cosigner as well. You want the contact details –

you want their full name, their email address, phone number, and also their address. You will put that into

the application because they will need to fill it out as well. If you go to our website on

InternationalStudentLoan.com and go to APPLY ONLINE, fill it out. It is only 2 questions long, should take

you no more than 10 seconds and you will get the list of lenders that you can evaluate. Yes, we can

definitely point you in the right direction. We give you the information, that way you can make the decision

that works best for you. Again, if you have any questions – let us know! We are here to help you make sure

you make the smart financial decisions. So send your questions to us at info@internationalstudentloan.com.

We have around the clock support for you, so that you get all of those questions answered especially as we

head into the busy season where we are going to have a lot of students applying. You can also use our social

media channels – so you can go to on Facebook, Twitter, and Google+ and we are constantly monitoring that.

So send us your questions so that we can make sure you are ready and prepared when that time comes to apply.

Answer: A scholarship is basically “free money.” So you are getting money from an

institution or organization that you don’t have to pay back. Usually they are very competitive because who

wouldn’t want free money? That is a great place to start if you need help funding your education – for your

tuition, your books, and for things like that. Student loans actually require you to pay back the money plus

a cost to borrow. So that’s the main difference between a student loan, where you’re going more through a

bank, and a scholarship which can go through a university. There is a lot of home country aid as well. Your

home country may have aid that will help you cover your expenses. Even private organizations like non-profit

organizations and companies that will sponsor students to go abroad and basically give you the money to help

you cover expenses and do not expect to get paid back the money. So scholarships are definitely the first

place to look, but sometimes that doesn’t cover it all, so that’s where the student loans come in.

Answer: Great question. The way that I look at it, first you apply for your school and you

are going to get a financial aid package. You may want to call them an ask them in advance to see what kind

of scholarships or fellowships that they offer. Sometimes students, US and sometimes international students,

find limited part time work. So that may be another option or avenue for you. Then you will want to look at

scholarships too, because again, that’s free money that will help you cover your expenses. At the very end,

if you have anything left over, you may want to look towards loans to help cover that. So that is basically

the process. I think about it more like a pyramid – you want to make sure that the most amount is your

scholarships, then any work that you can do (you can contact your international student advisor or US

advisor to see what options exist) and then fellowships, grants, and at the very end, whatever is left is

student loans.

At this point I think we have answered the majority of your questions. So, I hope that you have found this helpful.

I hope that you feel more prepared and are ready to start applying. If you go onto InternationalStudentLoan.com and

click on APPLY ONLINE, you can see the list of lenders there.

If you have any questions whatsoever, please send them our way. We will be doing more of these whiteboards and

hangouts so we want to make sure we get all of your questions answered and make you feel confident as you apply for

your student loan. So that’s all for me. Enjoy the rest of your day and thanks for tuning in.